When people think of stablecoins today, they usually think of USDT (Tether) and USDC. These are digital dollars, tokens designed to hold the same value as $1 so people can move money quickly across the world without worrying about crypto price swings. They’ve become the backbone of trading on most exchanges. But the stablecoin world is already starting to grow beyond them.

A new generation of stablecoins is emerging, often called “Stablecoins 2.0.” These newer models are trying to fix problems the first generation never solved, things like transparency, regulation, over-reliance on U.S. banks, and sometimes slow settlement.

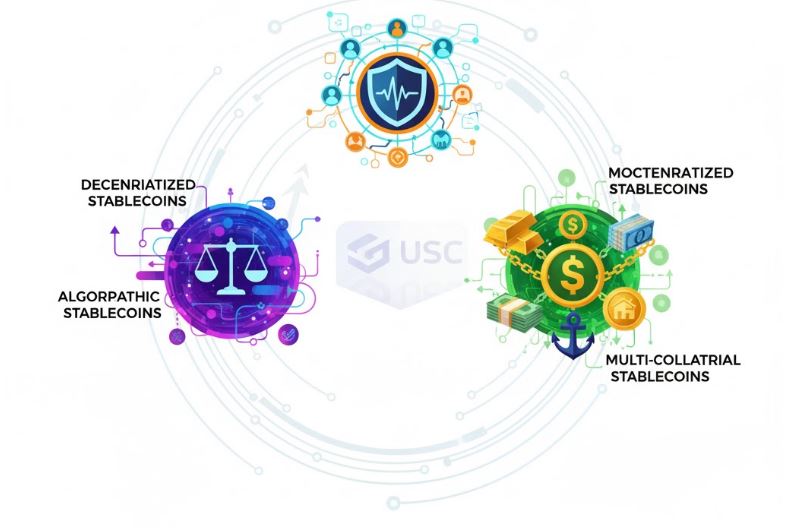

Some of these newer stablecoins are backed by real-world assets, such as short-term government bonds that earn interest. Others are designed to work across many blockchains at once instead of being trapped on just one network. Some are even trying to become more decentralized by removing the need for a single company to control the supply.

Another new idea is yield-bearing stablecoins, tokens that act like a dollar but also pass along the interest earned from the assets backing them. Instead of all the profit going to the issuing company, the holder can receive some of the return directly. This turns stablecoins from “digital cash that does nothing” into something closer to a low-risk digital savings tool.

There’s also growing interest in non-USD stablecoins. Most of today’s stablecoins are tied to the U.S. dollar, but people around the world are starting to ask for stablecoins based on euros, yen, or even baskets of currencies. This is part of a bigger shift toward giving users more choice and reducing dependence on a single country’s financial system.

The main reason stablecoins are evolving is simple: they’re no longer just a trading tool, they’re becoming part of everyday finance. People use them to send money, save, get paid for work, and move value across borders without banks slowing things down.

Stablecoins 1.0 gave crypto a stable foundation to build on.

Stablecoins 2.0 are about making that foundation smarter, fairer, and more global.

As this market grows, the most successful stablecoins may not be the ones with the biggest supply, but the ones that offer the most trust, utility, and economic freedom to their users.