Money is changing , again.

Not in the slow, subtle way that credit cards replaced cash, but in a way that could redefine what “money” even means. Governments around the world are exploring Central Bank Digital Currencies, or CBDCs, while the crypto world continues to push for a completely open, decentralized system.

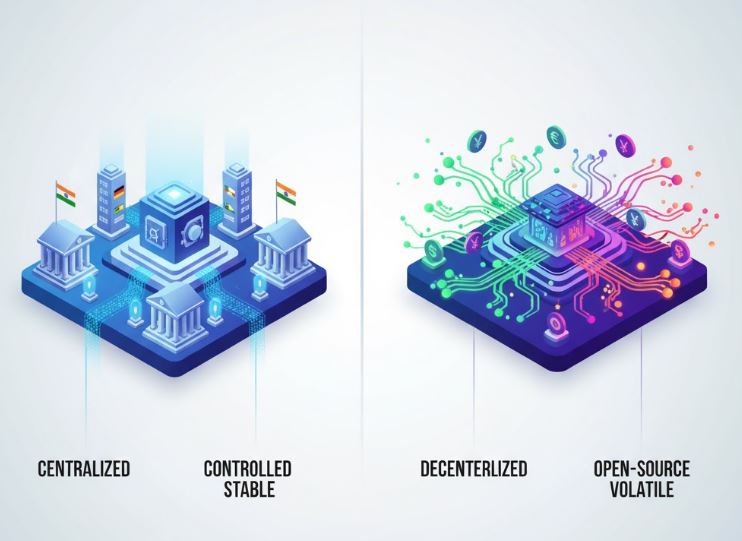

At first glance, they might sound similar. Both are digital. Both use blockchain-like technology. Both promise to make transactions faster and more efficient. But beneath the surface, they couldn’t be more different , not just in how they work, but in what they stand for.

A CBDC is, in essence, government-backed digital cash. Instead of printing paper bills, a central bank issues its currency directly in digital form. The goal is efficiency , faster payments, better control of money supply, easier access for people who don’t use banks. It’s like the dollar or euro you already know, but online, traceable, and programmable.

Cryptocurrency, on the other hand, was born from the exact opposite idea. Bitcoin and its descendants were designed to remove central control entirely , to let people exchange value freely, without needing permission from banks or governments. It’s not issued by anyone; it’s maintained by a network of users who agree on the rules through code. In crypto, trust is distributed. In CBDCs, it’s centralized by design.

That difference in philosophy is everything. A CBDC extends the reach of traditional finance into the digital age, while crypto attempts to build an entirely new financial world outside of it. One is about regulation and oversight; the other is about autonomy and privacy.

There are trade-offs, of course. CBDCs can help fight fraud, speed up payments, and make monetary policy more precise. But they also raise big questions about surveillance and control. If every transaction runs through a central ledger, how private is your money, really?

Crypto, meanwhile, gives freedom and transparency but also chaos. It can be volatile, hard to regulate, and vulnerable to scams. For all its promise, it’s still a risky playground compared to the stability people expect from official currencies.

It’s possible, though, that both systems will coexist. CBDCs could handle mainstream payments, while crypto evolves into a parallel network for those who value independence and innovation. They serve different needs , one for efficiency, one for empowerment.

The conversation around digital money isn’t just technical. It’s philosophical. Do we want a future where money is controlled from the top down, or one where it moves freely across borders and blockchains? Maybe the answer lies somewhere in between , a balance between security and freedom, oversight and autonomy.

Either way, one thing is certain: the next version of money won’t just live in your wallet. It’ll live on the network. And the choices we make now , about who controls it and how , will shape the way we spend, save, and trust for decades to come.